Californian is not being sold, but it might be one day. The US Debit is at 27 Trillion dollars as of Nov 2 2020. If you sold seven FANG (Facebook, Amazon, Netflix, and Google) companies and took 100% of those 7 FANG companies sales, you could not pay off the US Debt. Another way to look at US Debt, if you took every cent from the annual US tax revenue for 7 years (yes the Market Cap value of FANG is the same right now as the total US tax revenue) and applied that to the national Debt, you still could not get US out of debt.

What US citizen would the US citizen would be allowed to financially operate like the US Government? Answer is no one. We would eventually be put in jail after everything has been sized from us and we still could not pay our debt, or we would claim bankruptcy.

FANG Market Cap 3.581 Trillion

US Debt over 27 Trillion

FANG (Facebook, Amazon, Netflix, Google)

If the US were to claim bankruptcy, the world economy would unfortunately fail. So the pickle, since the US with a two party system will never stop increasing spending, and we cannot be taxed more than 100%; only logical conclusion is we will eventually be taxed 100% or the US will claim bankruptcy. I know this is dramatic but math never lies. The US will either claim bankruptcy because taxing US citizens 100% cannot happen or thinking out of the box, and what is more realistic is when the US get desperate and things really start to crumble, the US will start selling states off. What States do you think will be sold off by the US? Alaska maybe being close to China in between Russia and the US(China would buy it) or California (China would buy that too)?

Oh wait besides the national debt, there is also unfunded liabilities. This is the amount of money that is on the books to be paid to existing future bills. Think of it like you bought a cell phone on a two year plan. you owe two years. Your budget has this months charges, but you don’t have the other 23 moths, those are in unfunded liabilities. So the US has 155 trillion in unfunded liabilities. WTF for reals!! Yep true. So imagine if your unfunded liabilities was 45 times larger than your income for a year, and on top of that you spend more than you make every year, I know double WTF. And most politicians believe we should increase spending and taxes. If it were our house hold budget, we would decrease spending and increase income, not the US government, they play by their own rules sucker.

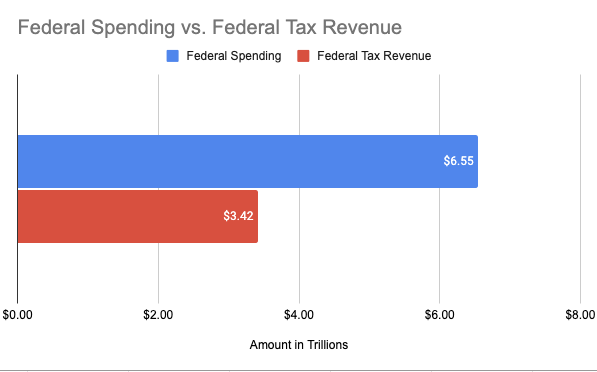

OK, so increase taxes. Lets say that we increase taxes to oh say 100% of everyones income. Yeah, no take home pay, just taxes. stay with me here. 2020 the personal income in the us was around 20 trillion. So you (everyone) would have to take zero thats $0 dollars home from your paycheck for more than a year, about a year and a half, then we could pay off the US Debt. OR another idea, we could liquidate everything the US owns (Assets) and then we could pay off the debt with some money to spare. But that 1 trillion to spare, we would eat up in about a half of year easily That is how much we over spend every single year. At least that. Remember none of that is taking into consideration unfunded liabilities (Social Security, Medicare, Veterans and a few other expenses).

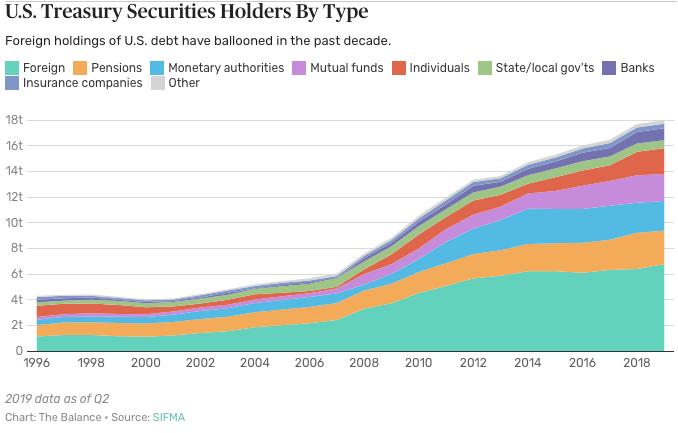

But here is the absolute very best part of them all. You will love this swindle bait in switch character building exercise. Oh this is good. So who owns the debt? Well as you would think some is owned by Foreign governments, yep they own stock in the US (thats what it is), also Pension plans own some US debt.

OK US Pensions really? isn’t that unfunded liabilities? Also Monetary Authorities (Federal Reserve), Individuals, State/local governments , Banks, Insurance Companies. Basically Other countries own some debt, you and me if we purchased some US Stock, and a large amount of US debt is owned by the US debt. Kinda like using a credit card to pay off another credit card. Nicely done Sam.

Deficit – Where is this going?

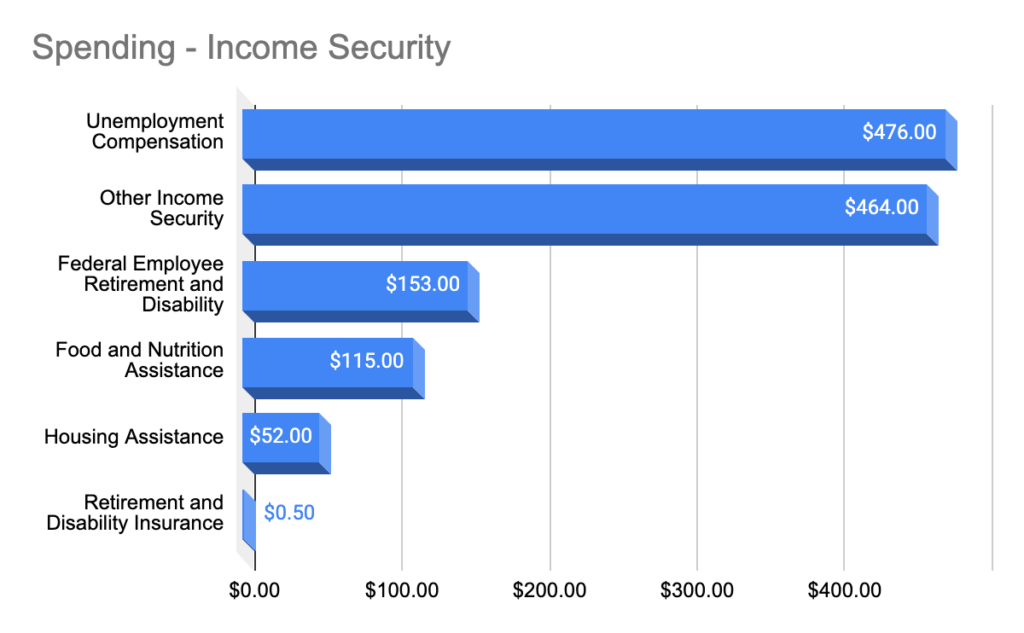

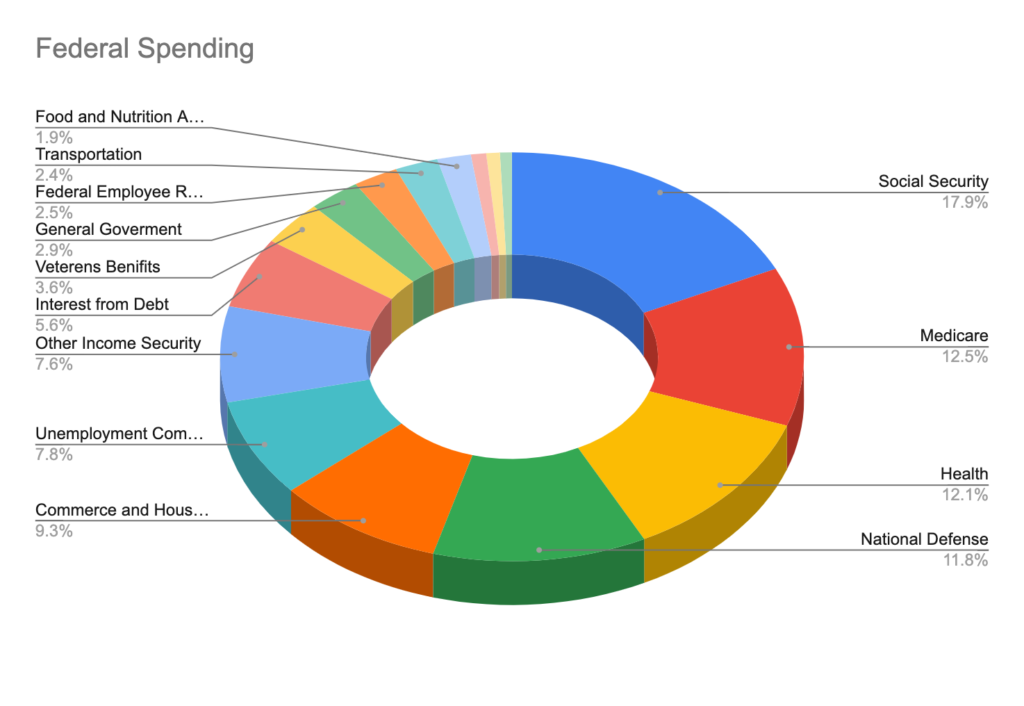

As you can see from the chart below, Medicare and Social Security take the majority of tax revenue. The 4th biggest spend “Income Security” is one I had to look up; is general retirement and disability insurance, federal employee retirement and disability, unemployment compensation, housing assistance, nutrition assistance; and other income security like foster care, supplemental security income and earned income and child tax credits.

Data in charts are from Datalab

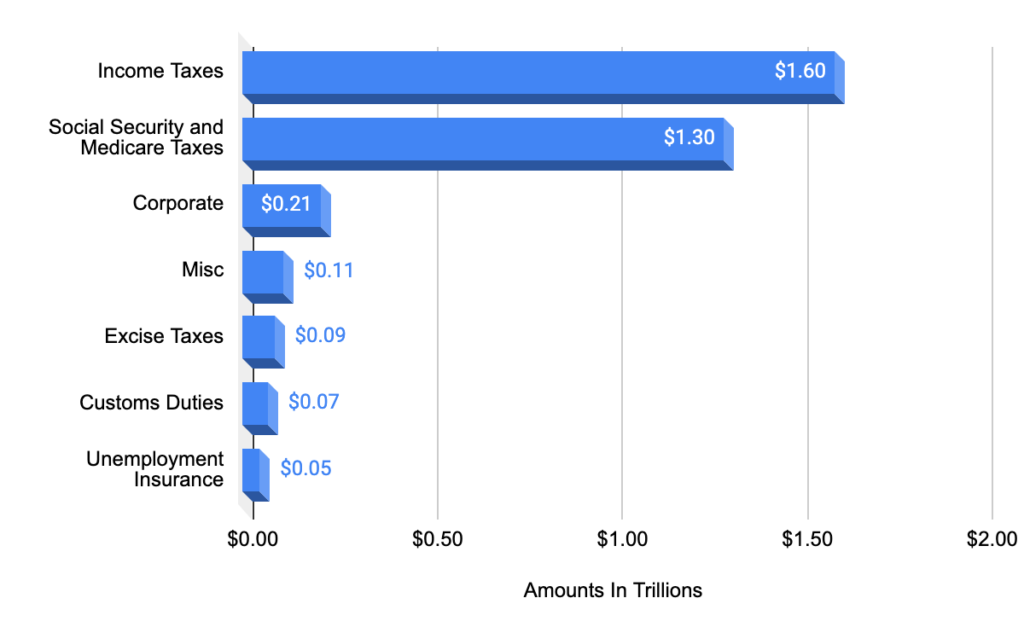

Federal Income

Federal Income has not changed much through time. Income tax has gone done about the same amount that social security tax has gone up. Corporate Taxes has gone down since 2016 by a third, which may seem like a lot. But keep this in mind. 1) Income Taxes and Social Security/Medicare taxes come out of your paycheck. Companies pay about the same amount in you do also as income and social security taxes, so half of what you see in the federal revenue charts are paid by corporations. The category called Corporate taxes are a very small amount of the taxes corporations pay. And that dip in “corporate taxes” being paid is about less than 1% of the taxes already pay as income, social security, medicare taxes.

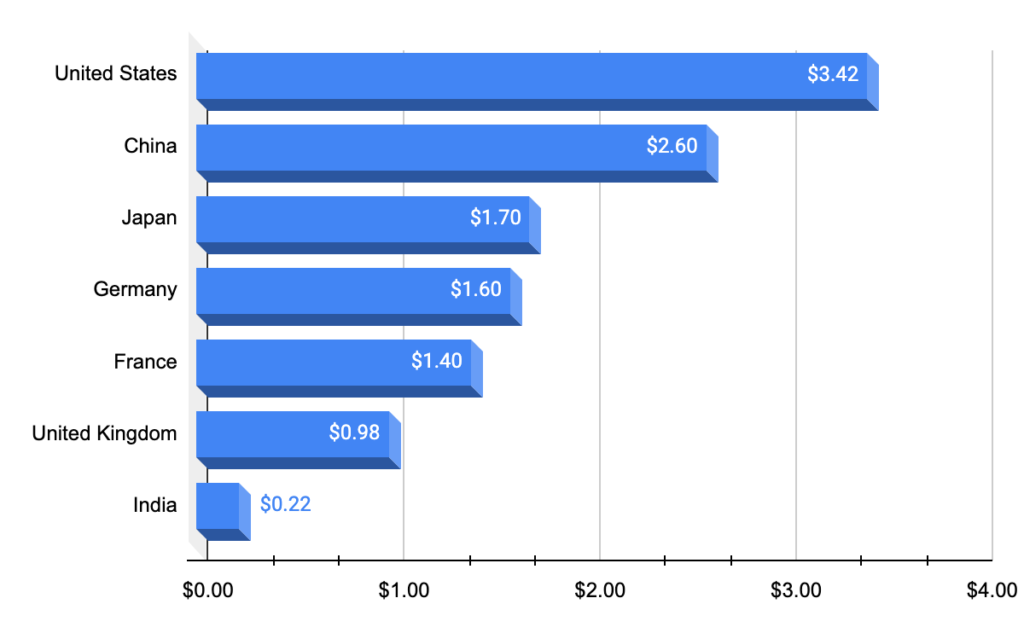

US income compared to other countries

As you see form a revenue standpoint, the us takes in much more per person than China. Compared to India, India pretty much doesn’t tax their people.

Source: fiscal.treasury.gov

Federal Spending

Spending categories in the chart below for the biggest categories I will place below the chart. Look over the chart, then read over the categories.

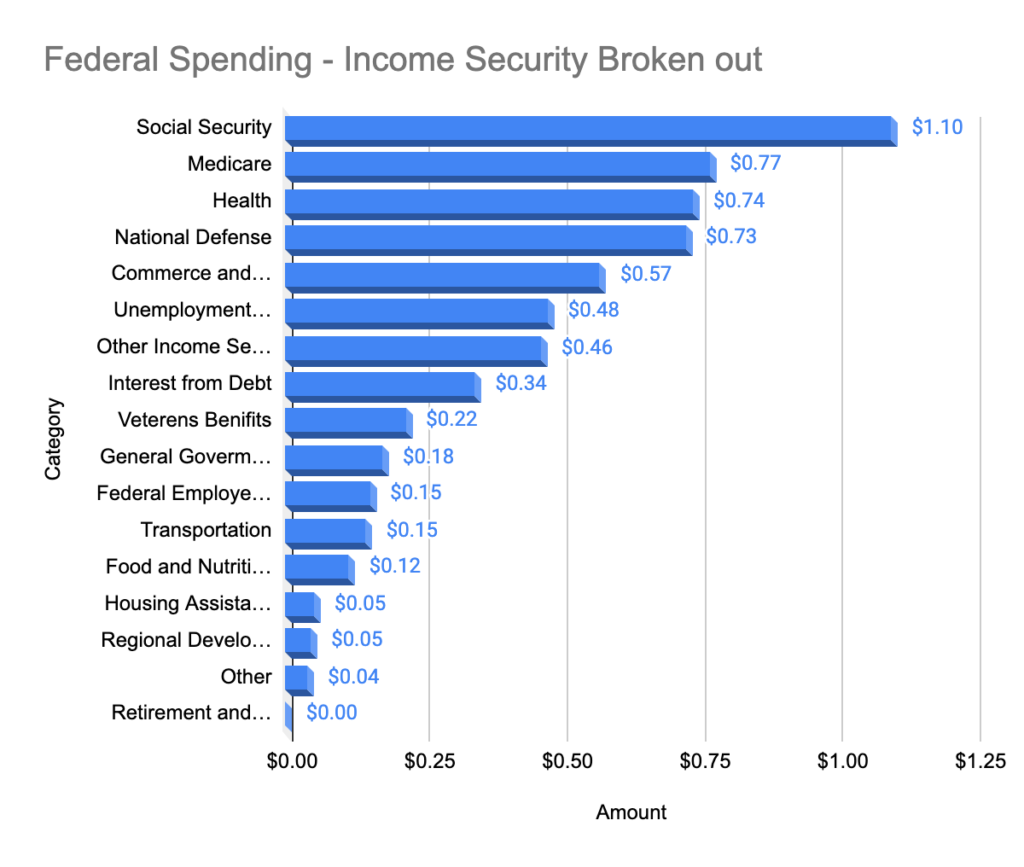

IMHO I thing the spending reporting should not batch together everything they do group together in the category “Income Security”. Here is what the chart should look like. Charts should be used to provide a picture of values, helping you make decisions and start making assumptions. To me grouping everything in a category called Income Security is not a good choice.

Below is the actual chart. Again data is from DataLab

| Category | Amount |

| Social Security | $1.10 |

| Medicare | $0.77 |

| Health | $0.74 |

| National Defense | $0.73 |

| Commerce and Housing | $0.57 |

| Unemployment Compensation | $0.48 |

| Other Income Security | $0.46 |

| Interest from Debt | $0.34 |

| Veterens Benifits | $0.22 |

| General Goverment | $0.18 |

| Federal Employee Retirement and Disability | $0.15 |

| Transportation | $0.15 |

| Food and Nutrition Assistance | $0.12 |

| Housing Assistance | $0.05 |

| Regional Development | $0.05 |

| Other | $0.04 |

| Retirement and Disability Insurance | $0.00 |

What is the difference between the public debt and the deficit?

The deficit is the difference between the money Government takes in, called receipts, and what the Government spends, called outlays, each year. Receipts include the money the Government takes in from income, excise and social insurance taxes as well as fees and other income. Outlays include all Federal spending including social security and Medicare benefits along with all other spending ranging from medical research to interest payments on the debt. When there is a deficit, Treasury must borrow the money needed for the government to pay its bills.

Covid Effect

You will noticed that 2020 has been a crushing blow to the already dismal outlook on US Debt. The chart below shows (in brown) the massive onslaught of new national debt. The one thing that I will be curious to watch is the future audits, the receipts I believe are severely over stated. There is no way we took in massive amounts of new Income Tax and Social Security charged on your paycheck when covid broke out. I believe when these audits occur, and numbers are correct, our national debt will take another massive debt making the total of US Assets less than the total US Debt. This is whats called F*(Ck3D.

Paying Off the Debt

OK, in reality selling California or Alaska or another state to pay off the debt, sure would work shy of any revolt not to mention the all the other civil catastrophic issues. I think it would be in our best interest to explore some other options.

Fiscal Responsibility

I know this is NOT popular by any means with politicians on any side of the aisle, but I see it as the only option short of selling a state or going Bankrupt. This is spending within our Means and adding debt payments that would actually pay off the debt in 100 years or less as part of our expenses. I have a spreadsheet if you are interested in the math. The math i modeled below would include increasing taxes (using 2020 numbers) and reducing spending. I know, I know it is what you and I do, but for our politicians who lie cheat, steal, give them selfs raises, great pensions, forever healthcare better than what we all have, this is a very foreign concept.

I based it off rounding our 27.### trillion debt to 28T. Use the 2019 average expense of all that debt, perform compounding interest using the years that we are modeling, add that debt payment to the revenue and what is left is what we can use for social security, pensions, military and all the other stuff we are blowing money on at a rate that does not come anywhere near as close as any other country that seems to function pretty well compared to our so called self proclaimed “Greatest Country on Earth”. Side note: the rest of the planet laughs at us when we proclaim ourselves that. I know we don’t have the market on corrupt politicians, but we definitely have the market share. USA, USA!.

Rant done, in all seriousness, if you look at the amount left over to spend on social services, and what we spend now, you can see how painful this will be to the US. In reality, this thing will snowball light is was covered in lighter fluid, started on fire and thrown at our face. Hot, Cold and Painful.

When you decrease the amount of money people and business have to spend on stuff, you decrease sales taxes and GDP. This will reduce the number of jobs and increase the weight on social services, or if we stick to our guns and do not pay for things we do not have money for, create mass poverty and non humanitarian conditions. Especially because we live in a society where humans watch other humans on decisive big media news stations that emotionally charge you at the same time desensitize you to the ruble of seeing a catastrophe and saying “Ow thats so sad, let’s get pizza”. Instead of in the 18th and 19th century when you would help people in need. I know there are people who do help, but that is a very small percentage.

Will the US ever Get out of Debt?

Once facts are analyzed, the truth is shown. The US will never get out of debt, will eventually default, and may have to do something very drastic to become financially in check. But that will not happen until the American public first gets educated on what debt will do to the US, and then demand their representatives to care more about protecting their future than giving in to donors interested for the sake of their job security. If “public servant” feels they will not be re elected because they cut spending in their state to help save the country, and they still do it, give them a medal, maybe a memorial. But right now there are no medals, politicians turn on politicians even within the same clan. Getting elected is more important than doing what is right for most representatives. One side of the mouth they say they want to Unit the Divided States of America, and in the other side of their mouth they poke prod and stir peoples emotions playin the average Divided States of Americans citizens as a pawn, and treat their bishops, queens and kings as royalty. This is not a game, and until people remove politics from public service, we will never get out of debt, will default.

What does Default Look Like

To know what US Default on Debt looks like you need to run through a model of default. Keep in mind that it is not a thing where the US will not pay back everyone, but it could be a very small default. The danger is there is no such thing as a small default. Once confidence erodes, the debut will snowball.

BBC did a great piece on what it would looked like if the US defaulted. https://www.bbc.com/news/business-24453400 check it out.

References

- US Personal Income https://www.statista.com/statistics/216756/us-personal-income/#:~:text=Personal%20income%20in%20the%20United%20States%20has%20risen%20steadily%20over,U.S.%20dollars%20at%20the%20time

- US Debt Clock https://usdebtclock.org/#

- 18 facts on the US National Debt that are almost too hard to believe https://fee.org/articles/18-facts-on-the-us-national-debt-that-are-almost-too-hard-to-believe/?gclid=Cj0KCQiAhs79BRD0ARIsAC6XpaU34GFGo6TcEGKwBH4Jzay_dN-CAx3BmyjR4Qu9AxX1v6XD1s9EeZUaAit9EALw_wcB

- Who owns the National Debt https://www.thebalance.com/who-owns-the-u-s-national-debt-3306124

- US Debt owners https://www.sifma.org/resources/research/us-treasury-securities-holders/

- US Debt TreasuryDirect.gov data https://www.treasurydirect.gov/govt/reports/pd/pd_debttothepenny.htm

- Treasury Debt owners in their own words https://www.treasurydirect.gov/govt/resources/faq/faq_publicdebt.htm#DebtOwner

- Good chart for seeing Social Security receipts since 1940 to 2017 https://www.taxpolicycenter.org/fiscal-fact/social-insurance-and-retirement-receipts-ff3262018#:~:text=Social%20Insurance%20and%20Retirement%20Receipts%20totaled%20%241.16%20trillion%20in%202017,the%201983%20Social%20Security%20reforms.